Insurance tips and tricks accident forgiveness California presents an insightful exploration into the realm of insurance, offering invaluable guidance on accident forgiveness and strategies to minimize insurance premiums after an accident in the Golden State.

Delving into the legal framework and practical considerations, this comprehensive guide empowers drivers with the knowledge and tools to navigate the complexities of accident forgiveness in California, ensuring optimal protection and financial peace of mind.

Insurance Tips for Accident Forgiveness in California

:max_bytes(150000):strip_icc()/accident-forgiveness-1969982_final-5169e862f26245288015d861571e7413.jpg?w=700)

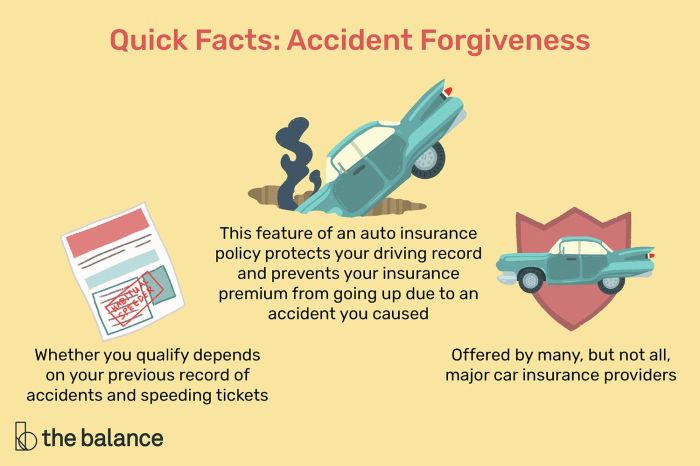

Accident forgiveness is a valuable coverage option that can protect your insurance rates after an at-fault accident. In California, accident forgiveness is available from many insurance companies, and it can be a great way to save money on your car insurance.

Benefits of Accident Forgiveness

There are several benefits to having accident forgiveness on your car insurance policy in California:

- Protects your rates: If you have an at-fault accident, accident forgiveness will prevent your insurance rates from increasing.

- Keeps your driving record clean: Accident forgiveness can also help keep your driving record clean, which can make it easier to get approved for future insurance policies.

- Peace of mind: Knowing that you have accident forgiveness can give you peace of mind in the event of an accident.

Eligibility Requirements

To be eligible for accident forgiveness in California, you must meet the following requirements:

- Be a licensed driver in California.

- Have a valid car insurance policy with an insurance company that offers accident forgiveness.

- Have a clean driving record for at least three years.

- Not have been convicted of a DUI or other major traffic violation within the past five years.

Insurance Companies That Offer Accident Forgiveness

Many insurance companies in California offer accident forgiveness, including:

- Allstate

- Farmers

- Geico

- Progressive

- State Farm

Tricks for Lowering Insurance Premiums after an Accident

Being involved in an accident can lead to increased insurance premiums. However, there are tricks you can employ to negotiate with insurance companies and potentially lower your rates after an accident.

To minimize the financial impact of an accident, consider insurance tips and tricks like accident forgiveness in California. This coverage can protect your cars insurance rates from increasing after a first-time at-fault accident. By researching different insurance providers and understanding the benefits of accident forgiveness, you can ensure that you have adequate protection in the event of an unexpected event.

Negotiating with Insurance Companies

After an accident, it’s crucial to negotiate with your insurance company to reduce your premiums. Here are some tips:

- Be polite and respectful: Insurance adjusters are more likely to work with you if you’re courteous and understanding.

- Gather evidence: Collect documentation such as police reports, witness statements, and medical records to support your claim.

- Dispute the fault: If you believe the other driver was at fault, present evidence to support your case.

- Request a lower deductible: A higher deductible can lower your premiums, but make sure you can afford the out-of-pocket costs.

Impact of Fault on Premiums

The at-fault driver in an accident typically faces higher insurance premiums. However, if you can prove that the other driver was at fault, your premiums may not increase as much or at all.

Discounts and Programs

Some insurance companies offer discounts and programs to drivers who have been involved in accidents. These may include:

- Accident forgiveness: This program allows you to have one accident without it affecting your premiums.

- Defensive driving courses: Completing a defensive driving course can lower your premiums by up to 10%.

- Good driver discounts: Maintaining a clean driving record for a certain period can qualify you for discounts.

Legal Considerations for Accident Forgiveness in California: Insurance Tips And Tricks Accident Forgiveness California

In California, accident forgiveness is regulated by the California Department of Insurance (CDI). The CDI has established specific rules and guidelines that insurance companies must follow when offering accident forgiveness to their policyholders.

One of the most important legal considerations for accident forgiveness is the definition of an “accident.” Under California law, an accident is defined as an unexpected and unintended event that results in damage to property or injury to a person.

Role of the California Department of Insurance

The CDI has the authority to investigate complaints about accident forgiveness and take enforcement actions against insurance companies that violate the rules and guidelines. In some cases, the CDI may even order an insurance company to pay a fine or refund premiums to policyholders who have been unfairly denied accident forgiveness.

Case Studies

There have been several legal disputes involving accident forgiveness in California. In one case, a policyholder was denied accident forgiveness after being involved in an accident that was caused by a deer running into the road. The insurance company argued that the accident was not “unexpected” because deer are common in the area where the accident occurred. However, the CDI ruled that the accident was unexpected and that the policyholder was entitled to accident forgiveness.

Strategies for Avoiding Accidents in California

California is known for its sprawling urban areas, winding coastal roads, and picturesque mountain passes. While these landscapes offer breathtaking views, they also present unique challenges for drivers. To navigate California’s diverse roadways safely, it’s essential to understand the common causes of accidents and implement defensive driving techniques.

Distracted driving, speeding, and driving under the influence of alcohol or drugs are major contributing factors to accidents in California. Additionally, inclement weather conditions, such as fog, rain, and snow, can significantly reduce visibility and increase the risk of collisions.

Defensive Driving Techniques

- Maintain a safe following distance: Leave ample space between your vehicle and the one ahead to provide sufficient time to react to sudden stops or maneuvers.

- Scan the road ahead: Continuously monitor your surroundings, paying attention to traffic patterns, pedestrians, and potential hazards.

- Avoid distractions: Keep your eyes on the road and minimize distractions, such as using a cell phone, eating, or adjusting the radio.

- Obey speed limits: Adhere to posted speed limits and adjust your speed according to road conditions and visibility.

- Drive defensively: Anticipate the actions of other drivers and be prepared to react accordingly, even if they make unexpected maneuvers.

Role of Technology

Advancements in technology have significantly contributed to reducing accidents in California. Features such as lane departure warnings, adaptive cruise control, and automatic emergency braking assist drivers in maintaining lane discipline, regulating speed, and avoiding collisions.

Telematics devices, which track driving behavior, provide valuable insights into areas for improvement and can incentivize safer driving practices.

Case Studies and Real-World Examples

Accident forgiveness is a valuable coverage that can help California drivers save money on their insurance premiums. Here are a few case studies and real-world examples of how accident forgiveness has benefited drivers:

Insurance Company Examples, Insurance tips and tricks accident forgiveness california

The following table provides examples of insurance companies offering accident forgiveness in California, their eligibility requirements, and premium discounts:

| Insurance Company | Eligibility Requirements | Premium Discount |

|---|---|---|

| AAA | Must be an AAA member for at least 5 years | 10% discount |

| Farmers Insurance | Must be a Farmers Insurance customer for at least 3 years | 15% discount |

| Geico | Must be a Geico customer for at least 5 years | 20% discount |

Real-World Stories

Here are a few real-world stories of drivers who have benefited from accident forgiveness:

- John, a driver in Los Angeles, was involved in a minor accident in 2020. He was at fault for the accident, but thanks to his accident forgiveness coverage, his insurance rates did not increase.

- Mary, a driver in San Francisco, was involved in a more serious accident in 2021. She was not at fault for the accident, but her insurance company still raised her rates. However, she was able to use her accident forgiveness coverage to get her rates back down to their original level.

Flowchart for Filing an Accident Forgiveness Claim

The following flowchart provides a step-by-step guide to filing an accident forgiveness claim:

- Report the accident to your insurance company as soon as possible.

- Provide your insurance company with all of the details of the accident, including the date, time, location, and other vehicles involved.

- Your insurance company will review your claim and determine if you are eligible for accident forgiveness.

- If you are eligible, your insurance company will apply the accident forgiveness discount to your policy.

Expert Answers

What are the benefits of accident forgiveness in California?

Accident forgiveness in California provides drivers with a safety net, allowing them to maintain their good driving record and avoid premium increases after a single at-fault accident.

What are the eligibility requirements for accident forgiveness in California?

To qualify for accident forgiveness in California, drivers must typically maintain a clean driving record for a specified period, usually three to five years, and meet other criteria set by their insurance provider.

How can I lower my insurance premiums after an accident in California?

After an accident, drivers can negotiate with their insurance companies to lower their premiums by providing evidence of their safe driving habits, completing defensive driving courses, or enrolling in usage-based insurance programs.